does indiana have a inheritance tax

In addition no Consents to Transfer Form IH-14. Indiana repealed the inheritance tax in 2013.

Historical Indiana Tax Policy Information Ballotpedia

Indiana inheritance tax was eliminated as of January 1 2013.

. At this point there are only six states that impose state-level inheritance taxes. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. No inheritance tax has to be paid for individuals dying after December 31 2012.

PA Department of Revenue. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12. There is no inheritance tax in Indiana either.

Indiana previously had an inheritance tax but it was repealed in 2013. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Indiana does not have an inheritance tax.

No tax has to be paid. Here in Indiana we did have an inheritance. Does Indiana Have an Inheritance or Estate Tax.

On the federal level there is no inheritance tax. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. However it is essential to file the deceaseds final federal and state income tax returns.

Indiana does not levy a gift tax. Thus there is no Indiana. Good news for Hoosiers doing their estate tax planning.

Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible. Twelve states and the. The Inheritance tax was repealed.

February 24 2021 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property.

Indiana does not place a tax on inheritances or estates. The federal government has a gift tax though with a yearly exemption of 15000 per recipient. Pennsylvania s income tax rates were last changed eighteen years prior to 2020 for tax year 2002 and the tax brackets have not been changed since at least 2001.

Power Of Attorney Ih 28 Indiana

Transfer On Death Tax Implications Findlaw

What Is Inheritance Tax Probate Advance

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

State Estate And Inheritance Taxes

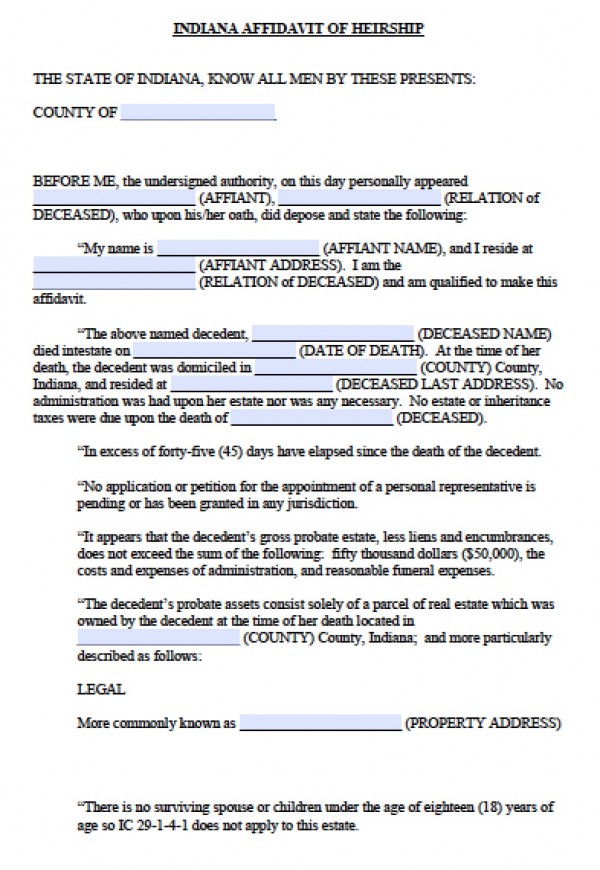

Free Indiana Affidavit Of Heirship Form Pdf Word

Dor Unemployment Compensation State Taxes

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

State Death Tax Hikes Loom Where Not To Die In 2021

Dor Completing An Indiana Tax Return

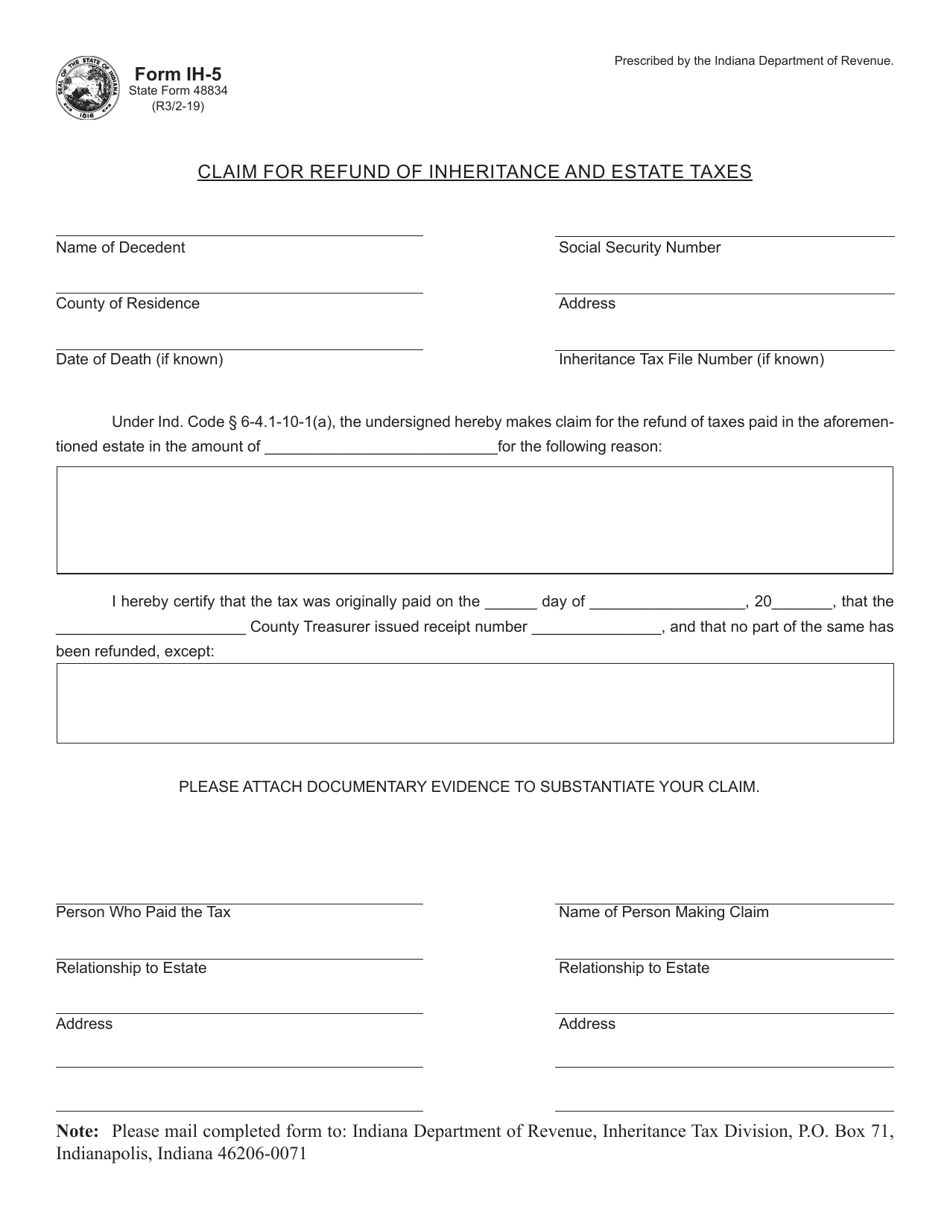

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Chart Of The Indiana Inheritance Tax Law 1915 Library Of Congress

What Should I Do With My Inheritance Inside Indiana Business

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Changes Made To Indiana Taxpayer Refund And Inheritance Tax News 2012 Indiana Public Media

Chart Of The Indiana Inheritance Tax Law 1915 Library Of Congress